The current MRK payout ratio is 9097. With a quarterly payout of 044 and a noted trailing EPS over.

Earnings growth looks.

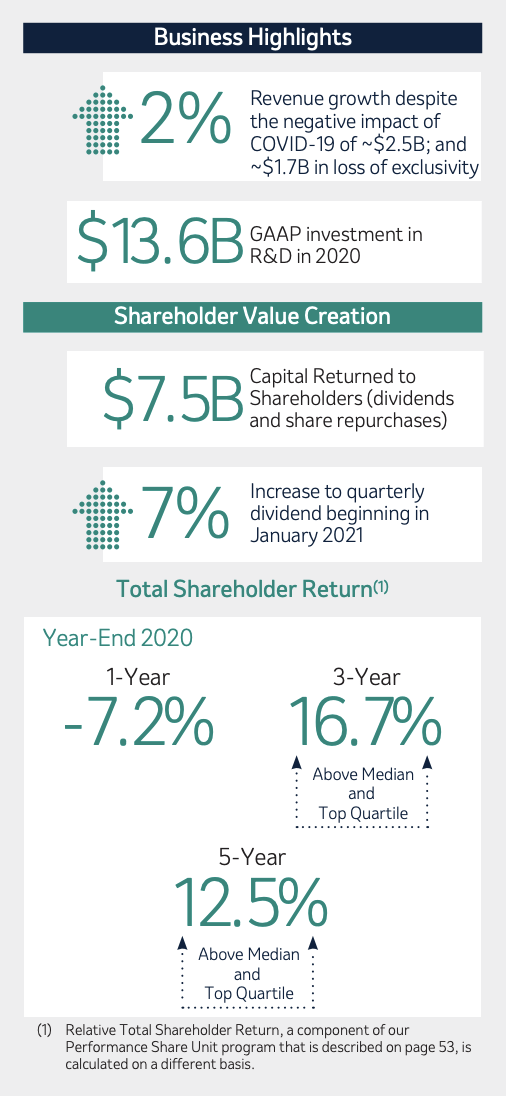

Merck stock dividend payout ratio. Cash Dividend Payout Ratio measures the amount of cash dividends that a company pays out in comparison to their total cash flow available to shareholders. Get a weekly snapshot of one. Dividend Growth Growth Rate Payout Ratio and Yield The company has already increased its dividend for 10 consecutive years.

Currently Merck pays out a 260 dividend per share. The current TTM dividend payout for Merck MRK as of September 24 2021 is 260. We dont have information about an expected dividend for Merck X.

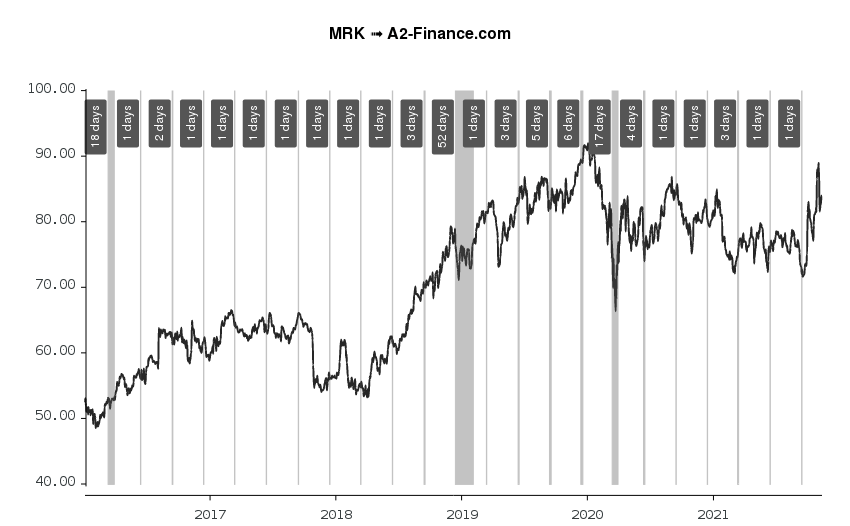

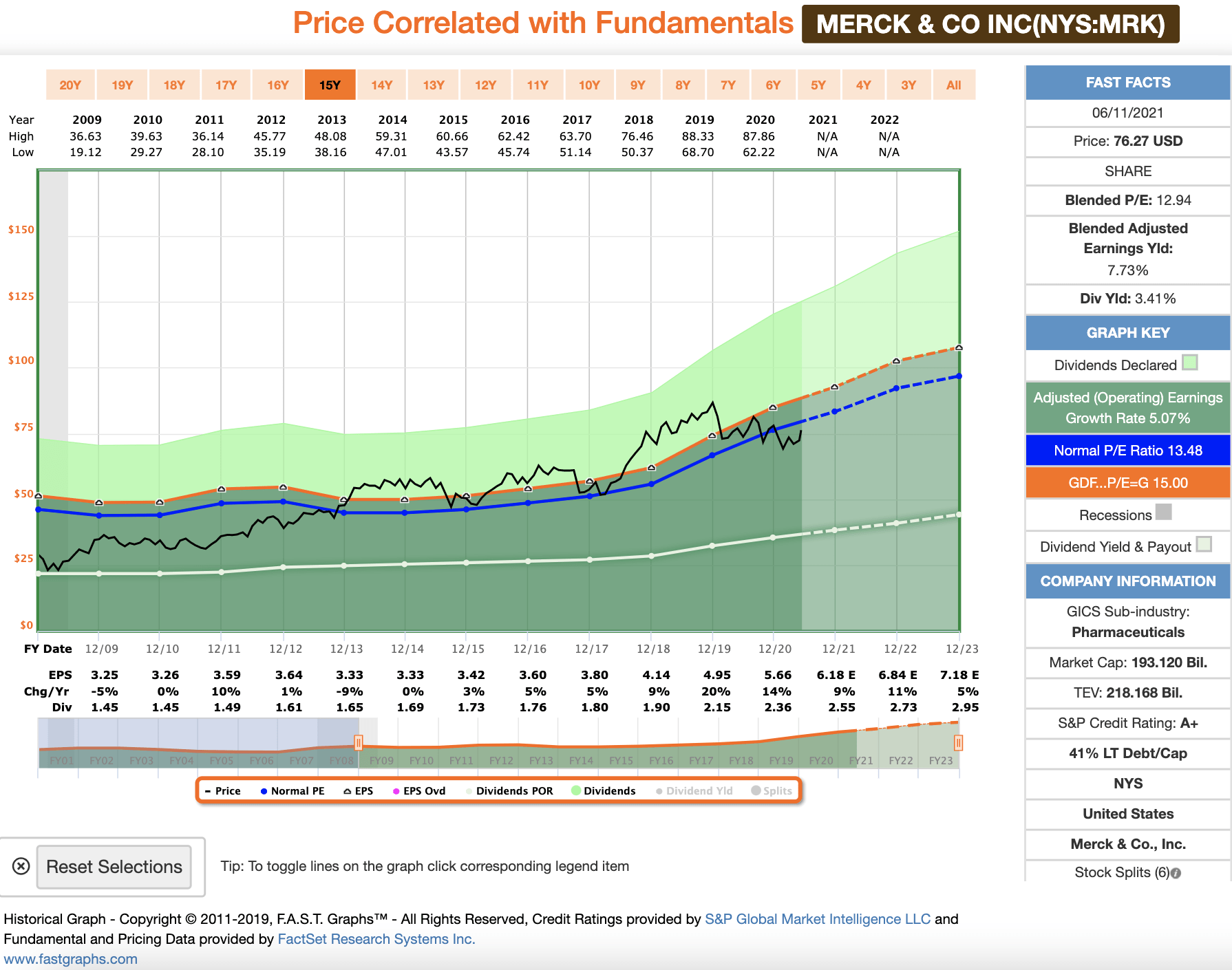

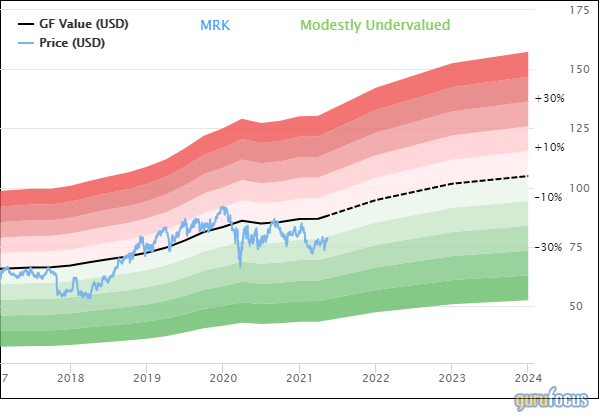

Discover Stocks to Buy. Mercks current payout ratio is 45. MRKs current price of 7868 a share implies a current PE ratio of about 14 which is a good value for the 128 annual earnings growth that analysts are expecting over.

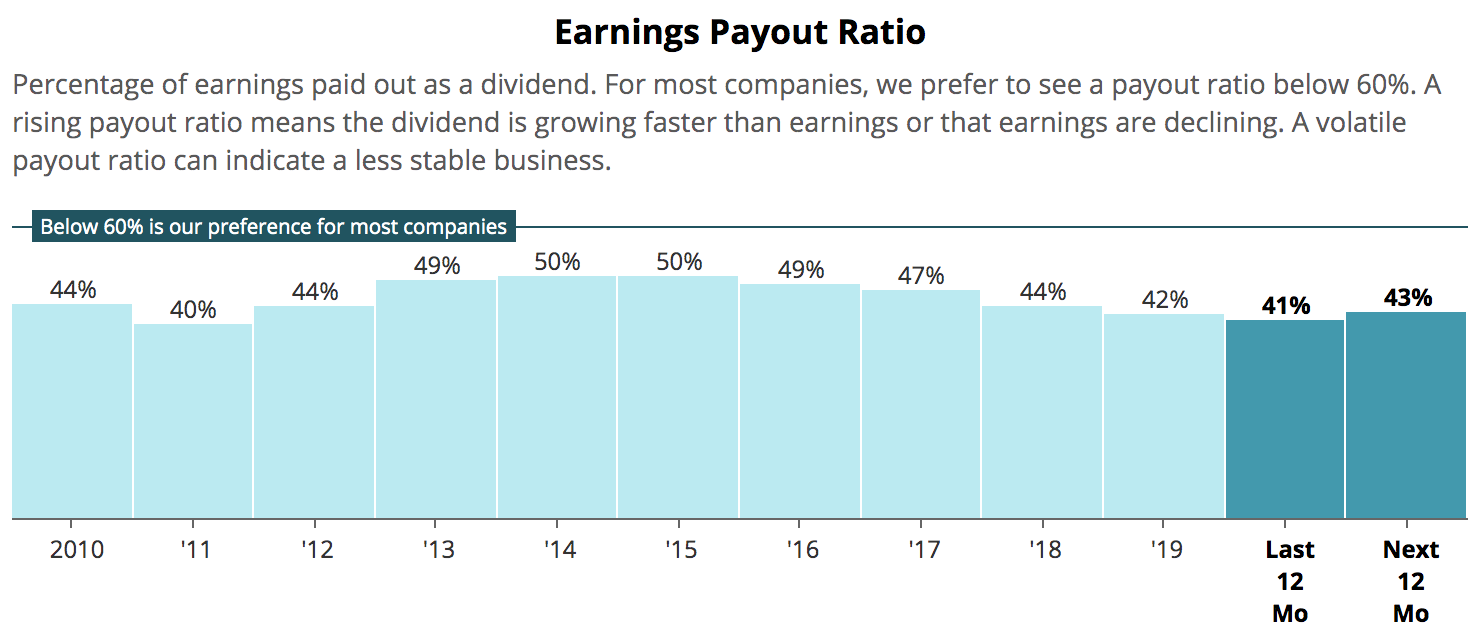

Based on MRKs guidance for 547-557 in non-GAAP EPS this year and a dividend per share obligation of 260 MRKs dividend payout ratio should clock in at a sustainable sub-50 level this year. Mercks current payout ratio is 45. The current dividend yield for Merck.

4140 based on next years estimates. MRKs dividend payout ratio is 1164 which is not sustainable. In depth view into MRK Dividend Payout Ratio explanation calculation historical data and more.

No MRKs past year earnings per share was 220 and their annual dividend per share is 260. Get a weekly snapshot of one new investment. 4719 based on this years estimates.

A stocks dividend reliability is determined by a healthy payout ratio that is higher than other stocks. This is why it is essential to look at the dividend payout based on earnings and free cash flow FCF. Next Dividend Payment We dont have information about an expected dividend for Merck.

Dividend History MRK Merck Co. Does Merck have sufficient earnings to cover their dividend. This means it paid out 45 of its trailing 12-month EPS as dividend.

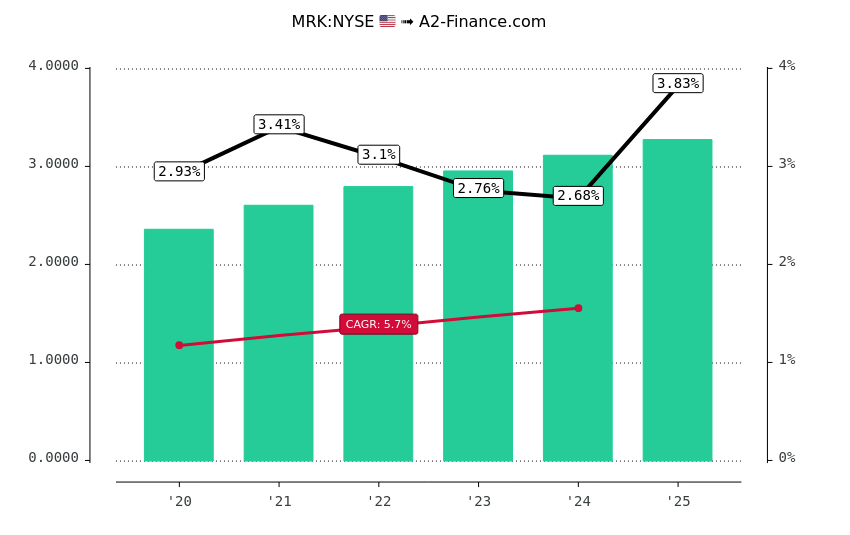

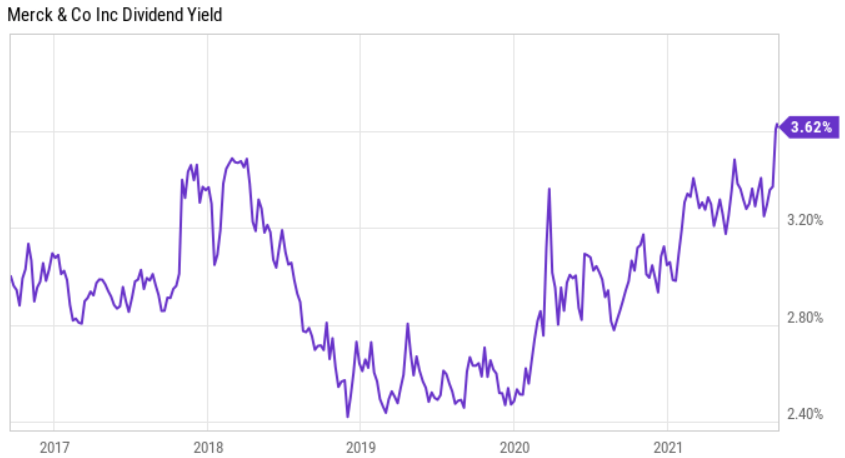

Looking at this fiscal year MRK expects solid earnings growth. Merck raises dividend 11 to 061 quarterly. With a five-year dividend growth rate of 63 which comes on top of the stocks yield of 34 the stock offers an appealing combination of growth and yield.

The dividend payout ratio for MRK is. A company that pays out close to half its earnings as dividends and retains the other half of earnings has ample room to grow its business and pay out more dividends in the future. The current dividend yield for Merck 6MK is 234.

The current annualized dividend payout for Merck is 000. Cash Dividend Payout Ratio Definition. Earnings growth looks.

For a security the PriceEarnings Ratio is given by dividing the Last Sale Price by the Actual EPS Earnings Per. Earnings are expected to be 656 per share for the 2021 fiscal year. Omnicom pays a 39 dividend and has a 42 payout ratio.

Morningstar has a buy rating and an 89 fair value estimate for OMC stock. This means it paid out 45 of its trailing 12-month EPS as dividend. Dividend payout ratio analysis on Merck According to data provided by SP CapitalIQ Mercks current dividend payout ratio is 92.

4377 based on the trailing year of earnings. Mercks dividend payout ratio for the months ended in Jun. This means it paid out 45 of its trailing 12-month EPS as dividend.

The current dividend yield for Merck as of September 24. Merck Dividend Payout Ratio as of today July 20 2021 is 052. The current 6MK payout ratio is 000.

This metric is important for investors wanting a significant dividend outlook for a particular investment. PriceEarnings Ratio is a widely used stock evaluation measure. A low payout ratio gives more flexibility for dividend growth.

We should always ask this question if we are looking for an undervalued dividend growth stock to invest in. Based on earnings this gives a. This means it paid out 45 of its trailing 12-month EPS as dividend.

Morningstar has a buy rating and an 89 fair value estimate for OMC stock. Discover Stocks to Buy. Mercks current payout ratio is 45.

Raises dividend 146 to 055 quarterly. Mercks current payout ratio is 45 meaning it paid out 45 of its trailing 12-month EPS as dividend. Mercks is 777.

Next Dividend Payment We dont have information about an expected dividend for Merck We dont have information about an expected dividend for Merck X. This means it paid out 45 of its trailing 12-month EPS as dividend. If a company dividend payout ratio is too high its dividend may not be sustainable.

Looking at this fiscal year MRK expects solid earnings growth. Mercks current payout ratio is 44 meaning it paid out 44 of its trailing 12-month EPS as dividend. This means it paid out 45 of its trailing 12-month EPS as dividend.

The current annualized dividend payout for Merck. 317 rows If you want to include this stock in your dividend portfolio here are some dividend. The 260 dividend is 3346 of this estimate.

5 Strong Buy Dividend Stocks For July 2021 Nasdaq

Mrk Dividend History Ex Date Yield For Merck

Merck Is A Table Pounding Buy Here S Why Mrk Seeking Alpha

Mrk Dividend History Ex Date Yield For Merck

Mrk Dividend History Ex Date Yield For Merck

Dividend Sleuthing Merck Nyse Mrk Seeking Alpha

Merck Mrk Pharma Dividend Growth Dividend Power

Bigger Faster Stronger 3 Great But Flawed Dow Dividends The Motley Fool

Merck Mrk Pharma Dividend Growth Dividend Power

5 Strong Buy Dividend Stocks For July 2021 Nasdaq

Undervalued Dividend Growth Stock Of The Week Merck Co Mrk Dividends And Income

Dividend Sleuthing Merck Nyse Mrk Seeking Alpha

Merck Mrk Pharma Dividend Growth Dividend Power

Merck S Spin Off Plan Has Tradeoffs But Dividend Expected To Remain Safe And Growing Intelligent Income By Simply Safe Dividends

Merck Co Inc Stock Rating And Data Gurufocus Com